Ride-hailing giant Uber Technologies and AI powerhouse Nvidia might seem worlds apart, but until recently, they shared a significant stake in Serve Robotics (SERV). However, the revelation that Nvidia divested its entire holding at the close of 2024 sent Serve stock tumbling by over 50%. This dramatic drop followed news of Serve Robotics’ ambitious plans to deploy thousands of autonomous last-mile delivery robots this year, powered by Nvidia technology, in partnership with Uber Eats. As investors await Serve’s Q4 2024 financial results on March 6th, a critical question arises: does this steep stock decline represent a compelling buying opportunity in the Serve Robotics Stock market, or a warning sign?

Reimagining Last-Mile Logistics with Robotics

Serve Robotics is betting big on the future of last-mile delivery. The company argues that traditional food delivery models, heavily reliant on human drivers and cars, are inherently inefficient and costly. Serve envisions a paradigm shift where autonomous robots and drones become the backbone of local delivery networks. They believe that for smaller payloads, especially in dense urban environments, autonomous solutions are significantly more cost-effective, especially as AI hardware and software development becomes increasingly accessible and affordable. This vision directly impacts the potential of serve robotics stock as a long-term investment in logistics innovation.

Serve has developed advanced robots equipped with Level 4 autonomy. This means these robots can navigate sidewalks and operate in designated areas without human intervention. Since 2022, Serve’s robots have already completed over 50,000 commercial deliveries for approximately 400 restaurants across Los Angeles, achieving an impressive 99.94% accuracy rate. Serve claims this translates to a tenfold increase in efficiency compared to human delivery personnel, showcasing the tangible benefits of serve robotics in real-world applications.

The latest iteration, the Gen3 robot, represents a significant leap forward. It boasts five times the processing power of its predecessors, along with enhanced speed, extended operational range, and longer battery life. These improvements contribute to a 50% reduction in operating costs per delivery. Crucially, the Gen3 robot is powered by Nvidia’s Jetson Orin platform, leveraging cutting-edge hardware and software specifically designed for computer vision and advanced robotics. This technological foundation underscores the link between Nvidia’s expertise and Serve’s operational capabilities, even post-Nvidia stock divestment.

The economics of robotic delivery are compelling. Typical Uber Eats delivery fees using human drivers can range from free to $8, adding to the overall cost for consumers, in addition to service fees and tips. Serve aims to drastically reduce this cost, targeting a consistent $1 delivery fee. This cost advantage could be a game-changer, potentially driving higher order volumes and benefiting customers, restaurants, and delivery platforms alike. The prospect of lower delivery costs is a key factor influencing the attractiveness of serve robotics stock in the competitive delivery market.

Serve Robotics is optimistic about the market potential, citing a study by Ark Investment Management that projects the autonomous food delivery market to reach a staggering $450 billion by 2030. To capitalize on this massive opportunity, Serve is focused on scaling its operations. The company plans to deploy 2,000 robots this year through its expanded partnership with Uber Eats. This deployment will significantly broaden Serve’s footprint in California and extend its services into new geographic areas. Notably, Serve launched its Miami operations on February 19th, facilitating deliveries for popular chains like Shake Shack and Mister O1 Extraordinary Pizza via the Uber Eats platform. This expansion is crucial for demonstrating the scalability and market penetration potential of serve robotics and, consequently, the stock’s long-term growth trajectory.

Revenue Growth vs. Substantial Losses: A Financial Tightrope Walk

Wall Street analysts, as compiled by Yahoo! Finance, anticipate Serve Robotics’ upcoming financial report to reveal approximately $1.9 million in total revenue for 2024. This figure represents an astounding 820% year-over-year increase compared to 2023. Looking ahead to 2025, analysts project even more explosive growth, forecasting $13.3 million in revenue – a further 598% surge. This projected revenue jump hinges on the successful deployment of the 2,000 robots under the Uber Eats agreement. If Serve achieves this ambitious deployment, 2025 could be a pivotal year, validating its business model and demonstrating its capacity for rapid revenue scaling. Such revenue growth is a positive signal for investors considering serve robotics stock.

However, like many high-growth startups, particularly in the nascent AI and robotics sectors, Serve Robotics is currently operating at a significant loss. In the first three quarters of 2024 alone, the company reported a loss of $26.1 million, following a $24.8 million loss in 2023. With $50.9 million in cash reserves at the end of Q3 2024, Serve’s current burn rate is unsustainable in the long term. To bolster its financial position, Serve raised an additional $80 million in January through a new stock issuance. While this infusion of capital provides crucial runway, it also dilutes existing shareholders’ equity. Issuing new stock as a primary funding mechanism is not a long-term solution, and Serve must eventually address its substantial losses and chart a path towards profitability to ensure the long-term viability and attractiveness of serve robotics stock.

Serve Robotics Stock Valuation: Is it Justified After the Dip?

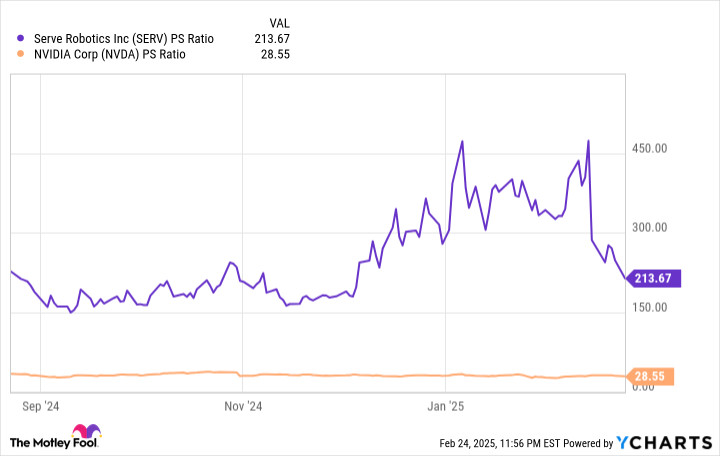

Despite the recent 50% stock price correction, Serve Robotics still commands a market capitalization of $581 million (as of this writing). Based on its trailing-twelve-month revenue, this translates to an exceptionally high price-to-sales (P/S) ratio of 213.6. To put this into perspective, Serve’s P/S ratio is approximately seven times greater than Nvidia’s, which trades at a P/S ratio of 28.5.

SERV PS Ratio data by YCharts

Even when considering the projected 2025 revenue of $13.3 million, Serve’s forward P/S ratio remains elevated at 45.1. This still significantly exceeds Nvidia’s forward P/S ratio, despite Nvidia projecting revenues exceeding $195 billion in its current fiscal year and generating substantial profits. Comparing Serve’s valuation premium to a highly profitable and established tech giant like Nvidia raises serious questions about whether the current valuation of serve robotics stock is justified.

While Serve Robotics possesses the potential to become a significant player in the burgeoning robotics industry, particularly if it captures a substantial portion of its estimated $450 billion addressable market, the current stock valuation appears detached from its present financial reality. The recent 50% stock price decline may not be the end of the correction, and further downward pressure is possible until the stock price aligns more closely with a reasonable valuation based on its current revenue and profitability outlook. The upcoming financial report on March 6th is unlikely to fundamentally alter this valuation concern.

Conclusion:

Serve Robotics operates in a high-growth sector with a compelling vision and demonstrated technological capabilities. The company’s rapid revenue growth and strategic partnership with Uber Eats are positive indicators. However, substantial ongoing losses and a still-premium stock valuation, even after a significant dip, present considerable risks for investors. While the long-term potential of autonomous delivery and serve robotics stock remains promising, investors might be wise to exercise caution and await further evidence of financial stabilization and a more reasonable stock valuation before considering Serve Robotics as a buy. For now, a wait-and-see approach appears prudent.