Serve Robotics (SERV), trading on Nasdaq, is making waves in the autonomous last-mile delivery sector. Currently priced at 3.33%, Serve is capturing investor attention due to its innovative approach and significant partnerships, most notably with Uber Technologies’ Uber Eats platform and tech giant Nvidia. These collaborations position Serve to potentially revolutionize food delivery and logistics. But is Serve Robotics stock a wise investment today? Let’s delve into the company’s prospects, financial health, and what the current stock price reflects.

The Autonomous Delivery Revolution: A $450 Billion Market Opportunity

Serve Robotics is tackling a fundamental question: why are heavy, fuel-inefficient cars used for short-distance deliveries of small items? The company argues that autonomous robots and drones offer a more efficient and sustainable solution. As the costs associated with artificial intelligence and robotics development decrease, these alternatives become increasingly viable.

Serve estimates that its autonomous robots can achieve delivery costs as low as $1 per order at scale. Leveraging Level 4 autonomy, Serve’s robots are designed to navigate sidewalks safely and independently in designated areas. Since 2022, these robots have successfully completed over 50,000 deliveries for 400 restaurants in Los Angeles, boasting an impressive 99.94% accuracy rate – significantly outperforming human delivery drivers in reliability, reportedly by a factor of ten.

The latest iteration, the Gen3 robot, is powered by Nvidia’s Jetson Orin platform, a comprehensive hardware and software solution for advanced robotics and computer vision. This new generation is five times more powerful than its predecessor, leading to a 50% reduction in operating costs thanks to increased speed, extended range, and longer operational hours.

Serve’s partnership with Uber Eats is a cornerstone of its growth strategy. By the end of 2025, Serve plans to deploy 2,000 robots under this agreement, expanding its operations beyond California to include cities like Dallas and Fort Worth, Texas. If this deployment proves successful, Uber could realize substantial cost savings by transitioning a larger portion of its deliveries to autonomous robots. Serve envisions a vast $450 billion market for autonomous last-mile logistics by 2030, highlighting the immense potential for growth in this sector.

Financial Runway and Growth Trajectory: Navigating the Tightrope

In the third quarter of 2024, Serve Robotics reported revenue of $221,555. While this figure represents a remarkable 254% year-over-year increase, it also indicates a significant sequential decrease from the $468,375 revenue generated in the second quarter of the same year.

This fluctuation is attributed to a one-time licensing agreement with Magna International. As part of their manufacturing partnership for the 2,000 robots, Magna paid Serve a $1.2 million licensing fee in Q2 for the rights to utilize Serve’s software in non-competing robotics applications. Consequently, Q3 revenue primarily reflected delivery service income, leading to the observed decline from the previous quarter.

Currently, Serve Robotics is in a phase of aggressive expansion and investment, resulting in substantial cash burn. In the first three quarters of 2024, the company spent $25.3 million, predominantly on research and development. With modest revenue generation, Serve recorded a net loss of $26.1 million during this period.

As of the latest reports, Serve’s cash reserves stand at $50.9 million. At the current spending rate, these reserves could be depleted within 18 months unless the company curtails expenditures or significantly boosts revenue. To address this, Serve established an at-the-market equity facility in November, enabling them to potentially raise an additional $100 million through the sale of new shares. While this provides further financial flexibility, it also carries the implication of diluting existing shareholder equity.

Major Backers: Nvidia and Uber’s Stake in Serve Robotics

Serve Robotics’ origins trace back to Uber’s acquisition of Postmates in 2021. Following the acquisition, Serve was spun off as an independent entity, with Uber retaining a significant stake, currently around 12% of Serve’s outstanding shares.

Nvidia’s involvement began in 2022 with an investment in Serve, and the chipmaking giant now holds approximately 8.4% of the company’s outstanding shares. The substantial ownership by both Uber and Nvidia demonstrates a strong vote of confidence in Serve’s vision and potential, aligning their interests with the long-term success of the autonomous delivery company.

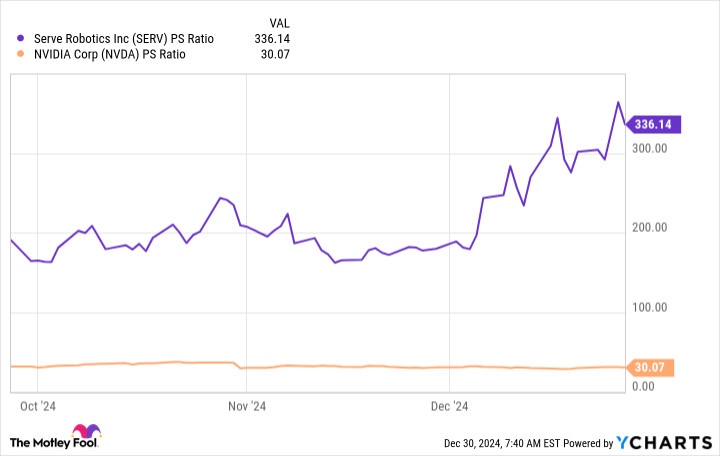

However, prospective investors should carefully consider Serve’s current valuation. With a market capitalization of approximately $700 million, Serve’s stock currently trades at a price-to-sales (P/S) ratio of 336 based on trailing-12-month revenue. This valuation is remarkably high, exceeding Nvidia’s P/S ratio by a factor of eleven.

SERV PS Ratio Chart displaying Serve Robotics' Price-to-Sales ratio over time, highlighting its premium valuation compared to industry peers.

SERV PS Ratio Chart displaying Serve Robotics' Price-to-Sales ratio over time, highlighting its premium valuation compared to industry peers.

While Nvidia boasts a proven track record, robust financials, and substantial annual revenue exceeding $100 billion, Serve is still in its early stages of commercialization. The premium valuation suggests significant market expectations for Serve’s future growth.

Wall Street analysts, as reported by Yahoo, project a potentially dramatic 598% increase in Serve’s annual revenue to $13.3 million in 2025, contingent on the successful deployment of 2,000 robots and the ramp-up of Uber Eats deliveries. Based on this projected revenue, Serve’s forward P/S ratio would be around 54.

Although a forward P/S ratio of 54 is more moderate than the current trailing ratio, it still represents a premium valuation, indicating a potential risk of stock correction. Therefore, investing in Serve Robotics at its current stock price involves a degree of risk, and investors should only allocate capital they are prepared to potentially lose.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Investors should conduct their own thorough research and consider their risk tolerance before making any investment decisions regarding Serve Robotics (SERV) stock. Always check with a financial advisor before investing in the stock market.