The recent surge in Artificial Intelligence (AI) has been impossible to ignore, permeating discussions across industries and capturing significant investment. Behind the flashy headlines about AI-powered chatbots and revolutionary algorithms lies a critical question: is the escalating demand for AI servers a sign of sustainable growth, or are we witnessing the inflation of another tech bubble? This question becomes even more pertinent when considering the Software as a Service (SaaS) industry, a sector heavily invested in AI as a potential growth engine.

Concerns are mounting, echoing sentiments highlighted in recent tech analyses. Reports of major players like Microsoft scrambling to reallocate server capacity for AI applications, even considering drastic measures to free up power for GPUs, paint a picture of intense pressure. This urgency raises eyebrows and prompts a deeper examination into the motivations driving this AI push, particularly within the established SaaS framework.

To understand the current landscape, we must first dissect the business model that underpins a significant portion of the tech industry – SaaS. While seemingly niche, SaaS profoundly impacts the software we use daily, especially in professional settings. The allure of predictable, recurring revenue through subscription models has propelled SaaS to dominance. However, this model, while initially beneficial, harbors inherent complexities and potential pitfalls, especially as organizations grow reliant on an ever-expanding suite of SaaS applications.

The Double-Edged Sword of Software as a Service (SaaS)

The SaaS model, at its core, offers convenience and scalability. Businesses avoid hefty upfront licensing fees and the burden of managing their own IT infrastructure. Monthly subscriptions, typically per user, provide access to cloud-based software, promising flexibility and cost predictability. For small to medium-sized businesses, this can be a game-changer, democratizing access to powerful tools.

However, the convenience of SaaS comes with a trade-off. Organizations become increasingly tethered to their SaaS providers. Managing a handful of SaaS subscriptions is manageable; scaling to hundreds or thousands introduces significant complexity. The very nature of SaaS, designed to be deeply integrated into workflows, creates vendor lock-in. Migrating away from a deeply entrenched SaaS ecosystem becomes a monumental, often prohibitively expensive, undertaking.

This “Software as a Disservice,” as it might be termed, arises from the SaaS industry’s growth imperative. The relentless pursuit of growth compels SaaS companies to continuously expand their offerings and deepen their integration within client organizations. Each new feature, integration, or user seat solidifies the SaaS provider’s position, often at the expense of the client’s agility and bargaining power. Innovation becomes dictated by the SaaS vendor’s roadmap, and organizations risk becoming stagnant, their technological trajectory dictated by external forces.

A graph with numbers and lines Description automatically generated

A graph with numbers and lines Description automatically generated

The pervasive nature of SaaS also explains the often-lamented quality of enterprise software. Decision-makers, often far removed from the daily user experience, are swayed by sales pitches and brand recognition, prioritizing cost-effectiveness and perceived industry standards over usability and actual functionality. The result is a landscape littered with mediocre software, deeply entrenched within organizations, simply because switching costs are astronomical and the initial purchase decision was often based on factors other than user needs.

Stagnating SaaS Growth and the AI Pivot

The SaaS market, despite its massive size and historical growth, is showing signs of deceleration. After years of explosive expansion, growth rates are slowing, and key metrics like Net Revenue Retention (NRR) are declining. This slowdown is not merely a minor dip; it suggests a potential saturation point in the SaaS market. Companies are facing increasing difficulty in acquiring new customers and upselling existing ones. The once-unstoppable growth engine of SaaS is sputtering, prompting a desperate search for new avenues of expansion.

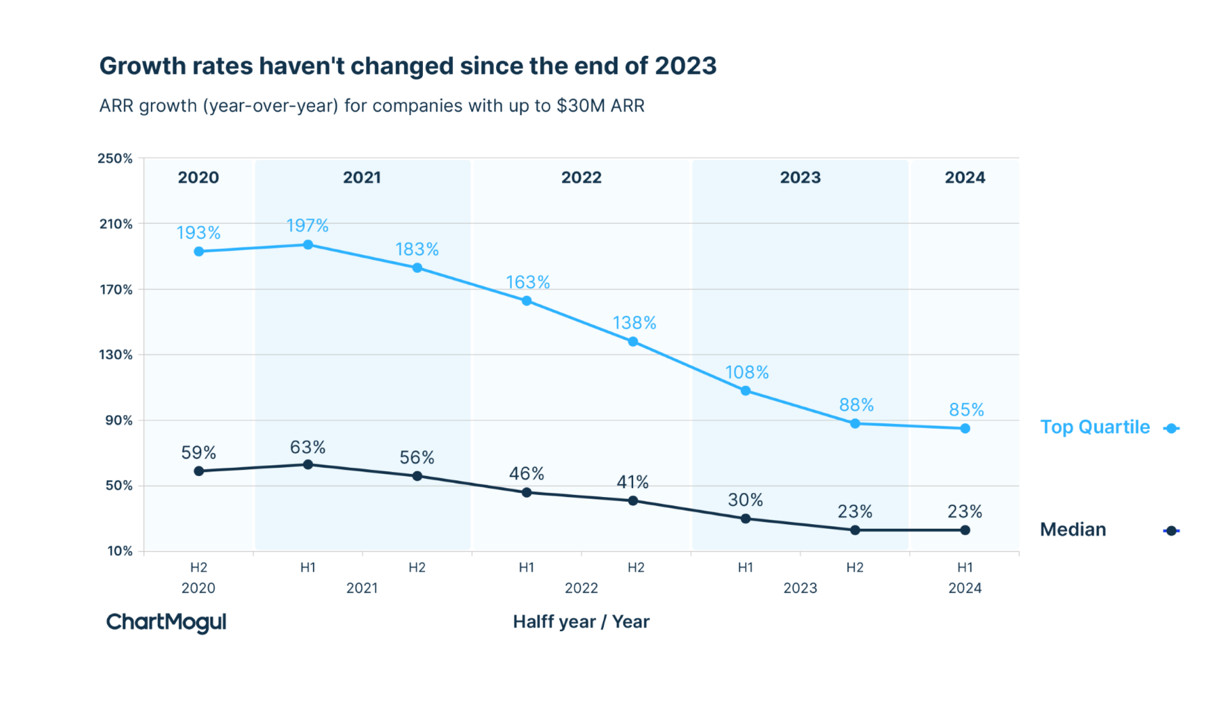

Research indicates a concerning trend: SaaS Annual Recurring Revenue (ARR) growth has been steadily declining since the pandemic peak. Median year-over-year growth rates have plummeted, and customer acquisition costs are rising. Crucially, Net Revenue Retention is weakening, signaling customer dissatisfaction, reduced spending, and increased churn. This combination of factors points towards a fundamental challenge to the SaaS “Go-to-Market Fit,” suggesting that the market’s appetite for conventional SaaS offerings may be waning.

This growth stagnation is not isolated to smaller players. Major SaaS companies across the board, from Atlassian to Workday and Salesforce, are experiencing a slowdown in year-over-year revenue growth. While tech giants like Microsoft, Google, and Adobe may mask the specifics by bundling SaaS revenues within larger business units, the overall trend is undeniable. The SaaS industry, a cornerstone of the modern tech economy, is facing a growth plateau.

AI: The New Growth Frontier for SaaS?

Enter Artificial Intelligence. In the face of slowing SaaS growth, AI emerges as a seemingly miraculous solution, a new frontier for revenue generation. For SaaS companies, AI presents a double opportunity: to sell the infrastructure underpinning AI development (cloud compute, AI servers) and to integrate AI capabilities into their existing SaaS offerings, creating new premium features and upselling opportunities.

The promise of AI is compelling. It’s perceived as a transformative technology, capable of revolutionizing workflows, enhancing productivity, and unlocking new levels of efficiency. For CEOs and CIOs under pressure to demonstrate innovation and growth, AI is an irresistible buzzword, a seemingly essential investment to remain competitive.

The dream scenario for SaaS companies is to leverage AI to sell “AI agents”— virtual assistants that can automate tasks, augment human capabilities, and potentially even reduce headcount. This vision fuels the current wave of AI-powered SaaS products, promising everything from AI-driven chatbots to automated content creation and intelligent data analysis.

However, a closer look reveals a less revolutionary reality. Many of these “AI-powered” features are essentially rebranded chatbots or incremental improvements built upon existing functionalities. They often lack concrete use cases and measurable productivity gains. The core value proposition is frequently vague, promising nebulous benefits like “enhanced productivity” and “reduced drudgery” without clear evidence of tangible impact.

The High Cost and Uncertain Value of AI in SaaS

The integration of AI into SaaS is not without significant challenges, most notably the high cost of generative AI. Large Language Models (LLMs) and the infrastructure required to run them are computationally intensive and expensive. This cost creates a dilemma for SaaS companies:

-

Offer AI Features for Free (or at minimal cost): This strategy aims to entice customers to upgrade to premium plans or renew existing contracts, using AI as a value-add. However, it risks burning significant resources to provide a service that may not generate direct revenue, potentially eroding profitability.

-

Charge a Premium for AI Features: This approach attempts to directly monetize AI capabilities, often through substantial price hikes. Examples include Microsoft’s Copilot add-on for Microsoft 365, priced at a significant premium per user per month. However, this strategy faces customer resistance, as many users are skeptical of the value proposition and hesitant to pay extra for features with unproven benefits.

Early data suggests that neither strategy is proving wildly successful. Microsoft’s Copilot, despite the hype, has seen limited adoption rates, with many customers questioning its value and balking at the high price tag. The Information reported that only a tiny fraction of Microsoft 365 users are currently paying for Copilot, indicating a significant hurdle in monetizing AI in the enterprise SaaS space.

Furthermore, even when customers do adopt AI-powered SaaS features, questions remain about profitability. Reports suggest that services like GitHub Copilot, despite being relatively popular, may be losing money for providers due to the high compute costs associated with generative AI. This raises serious concerns about the long-term financial viability of integrating expensive AI features into SaaS offerings, especially if customer adoption remains lukewarm.

AI Server Sales Growth: A Bubble in the Making?

The escalating demand for AI servers is undeniable. NVIDIA, a leading manufacturer of GPUs essential for AI workloads, is experiencing record sales and soaring stock prices. Cloud providers like Amazon Web Services (AWS) are also benefiting from the AI boom, as companies require massive compute resources to develop and deploy AI applications. This surge in AI server sales is a significant driver of growth in the semiconductor and cloud infrastructure sectors.

However, the crucial question remains: is this growth sustainable, or is it indicative of an AI bubble? The analysis presented here suggests reasons for caution. If the primary driver of AI server demand is the SaaS industry’s desperate attempt to reignite growth, and if these AI-powered SaaS features fail to deliver tangible value and generate sustainable revenue, then the current surge in AI server sales may be built on shaky foundations.

The risk of an AI bubble in the server market becomes apparent when considering the following:

- Unproven Monetization of AI in SaaS: As discussed, SaaS companies are struggling to effectively monetize AI features. If this trend continues, the demand for AI servers driven by SaaS deployments may plateau or even decline.

- Commoditization of AI Features: The rapid proliferation of AI-powered features across SaaS platforms may lead to commoditization. If every SaaS vendor offers similar AI capabilities, the competitive advantage and pricing power of these features will diminish, reducing their revenue-generating potential.

- High Costs and Questionable ROI: The high cost of generative AI, coupled with the uncertain return on investment for many AI-powered SaaS applications, may lead to budget cuts and a reassessment of AI spending within organizations.

If these factors converge, the current boom in AI server sales could be followed by a period of contraction, as the underlying demand fails to materialize into sustainable revenue streams. This scenario would resemble a classic tech bubble, characterized by inflated expectations, unsustainable investment, and eventual market correction.

Navigating the AI Hype: A Path Forward

The analysis does not suggest that AI is without potential. However, it urges a more realistic and critical assessment of the current AI hype, particularly within the SaaS context. For AI server sales to represent genuine, long-term growth, rather than a fleeting bubble, several key shifts are necessary:

- Focus on Tangible Value and Practical Applications: SaaS companies need to move beyond generic AI features and develop AI applications that address specific user needs and deliver measurable improvements in productivity and efficiency. The focus should shift from hype to demonstrable value.

- Sustainable Monetization Strategies: SaaS vendors must develop pricing models for AI features that are both attractive to customers and financially sustainable. This may involve exploring value-based pricing, tiered offerings, or alternative monetization approaches beyond simple per-user premiums.

- Cost Optimization and Technological Advancements: Continued innovation in AI infrastructure and algorithms is crucial to reduce the computational costs associated with generative AI. Lowering the cost barrier will be essential for broader adoption and sustainable profitability.

The future trajectory of AI server sales and the broader AI market hinges on these factors. If the industry can move beyond the hype cycle and focus on delivering tangible value, sustainable monetization, and cost-effective solutions, then the current growth in AI server sales may indeed signal a long-term expansion. However, if the current trajectory of inflated expectations and unproven business models persists, the risk of an AI bubble remains very real. The SaaS industry, in its pursuit of growth, must tread carefully to avoid fueling a bubble that could ultimately undermine the very technology it seeks to embrace.