Supermicro, a prominent system manufacturer, has recently demonstrated remarkable financial growth, primarily fueled by the escalating demand for AI servers. Just six months prior, discussions centered around the company’s breakthrough of a $10 billion annual revenue run rate, with aspirations set on reaching $20 billion. However, given the extraordinary surge in AI server demand and the complexities inherent in managing the supply chain and manufacturing of these sophisticated machines, targets of $25 billion or even $30 billion now appear more realistic.

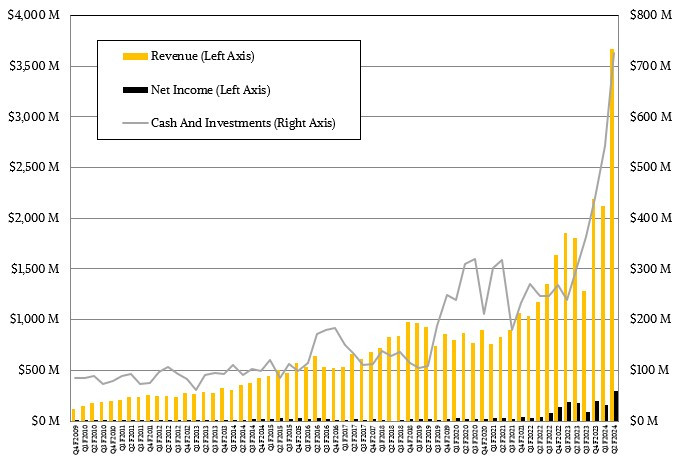

In the second quarter of fiscal year 2024, concluding in December, Supermicro’s financial results showcased exponential growth. Revenues more than doubled to an impressive $3.67 billion, marking a substantial 72.9 percent sequential increase from the already robust $2.12 billion recorded in the previous quarter. Operating income also experienced a significant uplift, rising by 72.8 percent to $371 million, while net income grew by 68 percent to $296 million. While these growth rates are substantial, it’s noteworthy that the net income as a percentage of revenue stood at just 3.4 percent. This is lower than the average of 9.1 percent observed in the preceding seven quarters when the generative AI boom was gaining momentum.

Supermicro Q2 Fiscal Year 2024 Revenue, Income, and Cash Flow

Supermicro Q2 Fiscal Year 2024 Revenue, Income, and Cash Flow

The rapid expansion Supermicro is undergoing, outpacing nearly every other entity in the IT sector except for Nvidia’s datacenter division, presents a unique challenge. To sustain this growth, Supermicro must aggressively expand its manufacturing capacity. This need for rapid scaling led to a recent $600 million stock offering, bolstering the company’s cash reserves to $726 million by the end of December. This financial maneuver provides a crucial buffer, enabling Supermicro to procure the necessary inventory to fulfill upcoming server rack orders.

With improvements in Nvidia H100 GPU availability, the emergence of credible AMD MI300X alternatives, and Intel’s foray into the market with its Gaudi2 devices, supply constraints are easing compared to the previous year. This shift means that demand is no longer capped by component shortages. For Supermicro, capitalizing on this environment to attract new customers and solidify its position as the premier AI server provider for large-scale operators hinges on competitive pricing, swift facility expansion, and exceptional customer service to foster long-term loyalty and repeat business. The aim is to secure future, higher-margin sales once the initial infrastructure build-out phase is complete.

However, the sustainability of this demand remains a key consideration. While the prevailing sentiment is optimistic, there’s always a possibility of demand deceleration.

“Overall, I feel very confident that this AI boom will continue for another many quarters, if not many years,” affirmed Charles Liang, co-founder and CEO of Supermicro, in a call with Wall Street analysts. “And together with the related inferencing and other computing ecosystem requirements, demand can last for even many decades to come. We may call this an AI revolution.” This perspective underscores the long-term potential and transformative nature of the current AI wave.

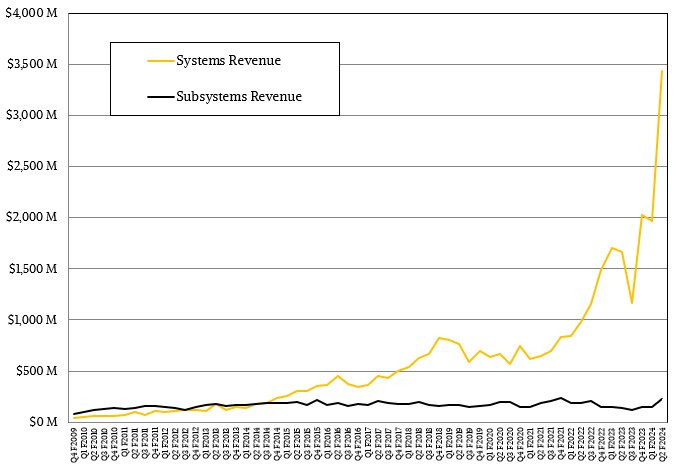

Supermicro Q2 Fiscal Year 2024 Systems vs Subsystems Sales Breakdown

Supermicro Q2 Fiscal Year 2024 Systems vs Subsystems Sales Breakdown

Supermicro’s business has evolved significantly from its origins as primarily a motherboard and adapter card supplier. This component-building expertise, however, has instilled a culture of flexibility and purpose-driven system design. In today’s market, where speed is as critical as compute, storage, and networking capabilities, Supermicro’s rackscale systems approach is proving to be a major differentiator. This strategy, targeting hyperscalers, cloud builders, and large enterprises, offers pre-configured, integrated solutions ready for immediate deployment. Supermicro’s ability to scale its rackscale manufacturing is, therefore, a critical factor in its continued growth. The company is strategically prioritizing long-term customer relationships over short-term profits to solidify its market position in this expanding sector.

While specific data on the rackscale segment of Supermicro’s business is limited, it’s known that in 2022, their rack production capacity was around 2,000 racks per month. Expansions in San Jose and Taipei, coupled with a new factory in Malaysia, have doubled this capacity to 4,000 racks per month. By the end of fiscal year 2024 in June, Supermicro anticipates reaching a 5,000 racks per month run rate, with 1,500 of these being direct liquid-cooled systems – increasingly vital for high-performance AI and HPC workloads.

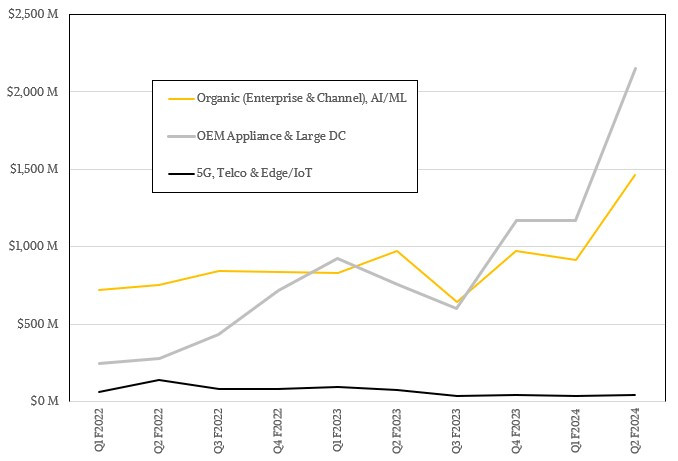

Supermicro Q2 Fiscal Year 2024 Customer Segmentation

Supermicro Q2 Fiscal Year 2024 Customer Segmentation

Over recent quarters, Supermicro has provided insights into the performance of its AI and rackscale system sales, often grouping these categories. While it’s reasonable to assume a significant overlap between AI servers and rackscale deployments, Supermicro reports them in conjunction. Notably, in Q3 FY2023, this combined AI/Rackscale business segment generated $372 million in sales, representing 29 percent of the total business. Subsequently, this percentage has consistently exceeded 50 percent for the past three quarters. Over the trailing twelve months, the AI/Rackscale category has contributed $4.5 billion in sales, accounting for 48.6 percent of Supermicro’s total $9.25 billion revenue.

The trajectory indicates that the super micro ai server sales percentage is poised for further growth. Supermicro’s rackscale offerings provide a deeper level of integration, including software installation, differentiating them from traditional original design manufacturers (ODMs) commonly utilized by hyperscalers and cloud providers. This enhanced service creates a positive feedback loop, and provided Supermicro maintains its GPU allocations, along with those of its major customers, the company is well-positioned to secure substantial infrastructure deals.

This dynamic fosters a beneficial ecosystem between Supermicro and key component providers like Nvidia, AMD, and Intel, driven by customer demand and facilitated by strong manufacturer relationships. Supermicro’s role as a builder of machinery for Intel’s internal use, particularly for EDA simulators, and rumored involvement in building DGX systems for Nvidia, further solidifies these relationships. Supermicro’s adeptness at nurturing ties with major compute engine and networking providers positions it favorably to capture market share from ODMs like Quanta, Inventec, and WiWynn, as well as ODM-like divisions within Lenovo and Inspur. This competitive advantage is further amplified by Supermicro’s status as a US-based company serving a significant American customer base.

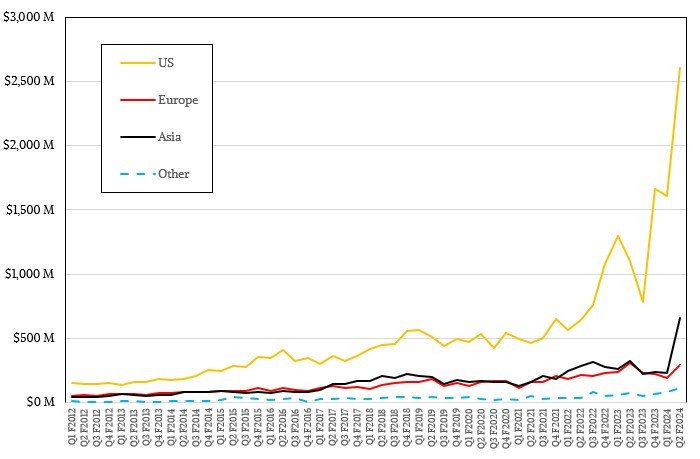

Supermicro Q2 Fiscal Year 2024 Geographic Revenue Distribution

Supermicro Q2 Fiscal Year 2024 Geographic Revenue Distribution

Geographically, Supermicro witnessed a remarkable 2.4X growth in its US business in fiscal Q2, reaching $2.6 billion. In contrast, European business contracted slightly by 4.4 percent to $293 million, reflecting the differing landscape of hyperscale cloud infrastructure deployment across regions. However, Asian business more than doubled to $660 million, suggesting significant gains in key markets like Japan and China. This substantial revenue increase in Asia indicates a clear shift in market dynamics and competitive positioning.

Wall Street’s optimism is notably fueled by Supermicro’s forward guidance. The company projects sales between $3.7 billion and $4.1 billion for fiscal Q3, and an overall revenue range of $14.3 billion to $14.7 billion for the full fiscal year ending in June. This guidance implies a substantial $4.82 billion in revenue for Q4 FY2024, signaling continued robust growth.

Supermicro’s potential to expand its business to $25 billion and beyond seems increasingly plausible. As infrastructure complexity escalates, and vendors like Supermicro take on more configuration and integration responsibilities, the trend towards rackscale adoption will likely accelerate. The critical question moving forward is whether Supermicro can leverage this added value to command higher profit margins or if it will become the new baseline expectation in the market.