what is due diligence

what is due diligence

In today’s complex business and legal landscape, making informed decisions is paramount. This is where due diligence comes into play. At its core, due diligence embodies the principle of taking prudent and well-informed actions before entering into an agreement or transaction. It’s about serving your interests diligently by thoroughly investigating and understanding all relevant aspects to avoid potential pitfalls and ensure favorable outcomes. This concept, now deeply ingrained in legal and business practices, essentially means to meticulously examine and conscientiously assess all available information before proceeding.

The formalization of due diligence meaning in law can be traced back to the Securities Act of 1933, enacted in the aftermath of the 1929 stock market crash. This landmark legislation aimed to bring transparency to financial markets. It mandated that security brokers and dealers faithfully execute their responsibilities by disclosing comprehensive data about the financial instruments they offered. They became obligated to thoroughly audit companies prior to offering securities, ensuring the financial health of these instruments. This legal framework was designed to protect investors and mitigate risks within the financial system.

Example of Due Diligence in Legal Context:

- Within the legal realm, demonstrating due diligence can serve as a robust defense against allegations of negligence or statutory offenses like tax evasion. By showing that an individual or corporation took industrious steps to prevent wrongdoing, they can mitigate or negate liability.

Contingent Due Diligence in Real Estate: What Does It Mean?

In the realm of real estate, contingent due diligence signifies a conditional expression of interest from a prospective buyer. It acts as a crucial safeguard for buyers entering into property transactions or investments. This type of due diligence is “contingent” because the final decision hinges on the satisfactory completion of investigations.

Example of Contingent Due Diligence in Action:

- A buyer conducting comprehensive site visits and property inspections exemplifies contingent due diligence. The progression of the real estate deal is directly tied to the findings of these assessments. If the inspections reveal unacceptable issues, the buyer retains the right to withdraw.

The essence of contingent due diligence is that the ultimate decision to move forward is assiduously dependent on the buyer’s findings during their investigative process. This provision allows companies or individuals to withdraw from a deal if their discoveries are unsatisfactory, protecting them from potentially unfavorable investments.

Due Diligence in Business: A Prudent Approach

Due diligence in business contexts refers to the practice of organizations exercising caution and foresight by meticulously evaluating associated costs and risks before finalizing transactions. It’s about earnestly pursuing a path of informed decision-making.

Example of Due Diligence in Business Operations:

- In corporate finance, due diligence investigations provide a “reasonable investigation defense” for parties involved in securities offerings under Section 11 of the Securities Act of 1933, excluding the issuer. This demonstrates a conscientious performance of their responsibilities.

- Everyday business examples include thoroughly researching before purchasing new property or equipment, implementing new business information systems, or engaging in mergers and acquisitions.

Business audits are an integral part of due diligence, helping to uncover and prevent potential problems down the line. This process also establishes a solid foundation for any legal opinions the firm may need to provide in connection with a transaction.

Organizations demonstrate due diligence by:

- Reviewing customer feedback and seller reputation: This involves diligently serving their own interests by understanding the reliability of partners.

- Assessing environmental impact: Considering the broader consequences of a transaction is a sign of responsible and diligent business practice.

- Securing insurances and warranties: Supplementing purchases with protections showcases a thorough approach to risk management.

- Evaluating price competitiveness: Comparing prices against competitors ensures a well-informed and prudent financial decision.

Financial Due Diligence: Delving into the Numbers

The financial due diligence definition centers around an in-depth examination of another company’s financial records. Businesses undertake this financial investigation before entering agreements, especially when considering substantial investments, mergers, or acquisitions. The primary goal is to accurately assess the target company’s value and identify potential financial risks. It’s about assiduously attending to the financial details.

A common question arises: what are the due diligence documents required? Key materials and documents analyzed during financial due diligence include:

- Revenue, profit, and growth patterns

- Stock history and stock options

- Short-term and long-term debt obligations

- Valuation multiples and ratios compared to industry benchmarks and competitors

- Comprehensive financial statements: balance sheets, income statements, and cash flow statements

To effectively gauge market perception of a company’s strengths and weaknesses, answering financial due diligence questions and analyzing the aforementioned documents using a financial due diligence checklist – playbook is crucial. Financial due diligence checklists are essential tools for companies to prevent oversights that could have negative repercussions after a deal is finalized. You can explore the components of such checklists here.

financial due diligence playbook

financial due diligence playbook

Due Diligence for Startups and Stocks: Investing Wisely

What is due diligence for startups? In the context of startups, due diligence is akin to a detailed preliminary review before making an investment. It’s about devotedly working to understand the potential of a new venture. Investors meticulously evaluate a startup’s business model, financial health, market opportunity, and the leadership team. For instance, they would assess the uniqueness of the product or service, market demand, and the team’s capabilities to execute their plan. This process empowers investors to make informed decisions about whether a startup is a worthwhile investment.

Similarly, what is due diligence for stocks? When considering stock investments, due diligence means conducting thorough research before purchasing shares in a company. It’s about wholeheartedly committing to understanding a company before investing. Investors analyze company financials, competitive landscape, and industry trends. They might examine profitability, growth rate compared to competitors, and adaptability to technological advancements. Creating a personal due diligence report assists investors in making sound choices about stock acquisitions.

Consequences of Expired Due Diligence Periods

Often, Letters of Intent (LOI) incorporate a Due Diligence Clause, outlining the procedures, rights, and responsibilities during the investigation phase, as well as the post-investigation steps, particularly in commercial due diligence.

However, the intensive nature of a due diligence audit can present challenges for firms. Meeting strict deadlines for gathering all pertinent information can be difficult. If a deadline is missed, the buyer must rely solely on the information gathered up to that point to decide whether to proceed with the deal.

In situations where the buyer feels their investigation was insufficient, they might request an extension from the seller. Sellers may or may not grant these extensions, potentially leading to frustration on both sides.

The key takeaway is that efficiency, productivity, and effectiveness are paramount in the due diligence process.

Key Areas of Due Diligence

Due diligence is typically initiated in business for two primary transaction types: the sale or purchase of goods and services, and mergers or acquisitions. Within each type, investigations are conducted across several key areas.

In general transactions, the objective of due diligence is to confirm the soundness of a purchase decision. Areas of scrutiny can include:

- Warranties provided

- Inventory assessments

- Customer reviews of the seller

Enhanced due diligence in mergers and acquisitions is significantly more comprehensive. It involves auditing areas such as:

- Financial records in detail

- Business plans and operational practices

- The target company’s customer base

- Current and pipeline products or services

- Human resources data

- Sustainability practices and environmental impact

A frequently overlooked but crucial area is self-assessment. Organizations should proactively assess their own corporate needs and objectives for the transaction. A well-executed self-assessment sets the stage for successful integration.

due diligence playbook

due diligence playbook

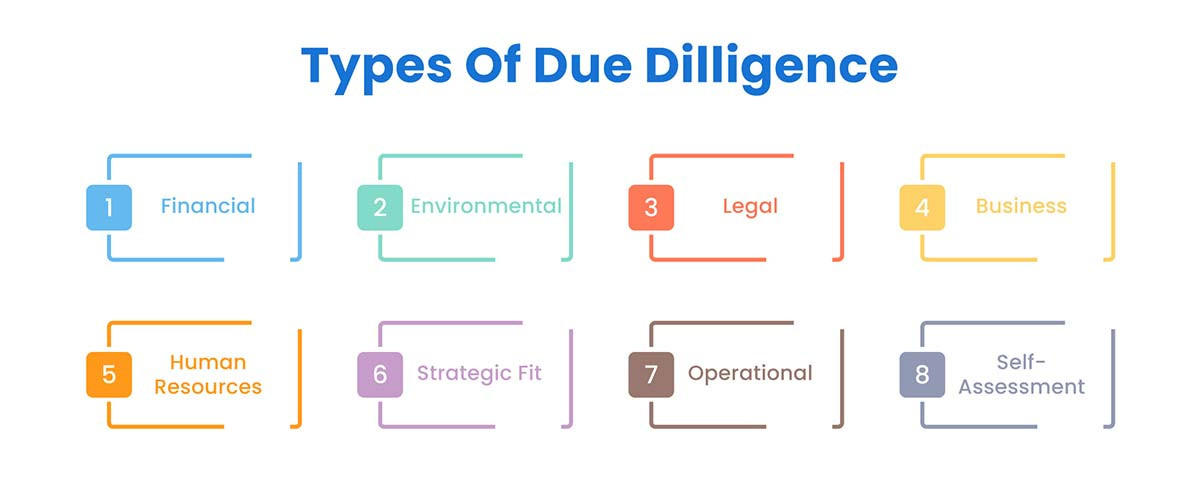

Types of Due Diligence: A Comprehensive Overview

Comprehensive audits are essential, but knowing where to begin can be challenging. Here are eight types of due diligence investigations to ensure thorough risk and pressure point coverage:

types of due diligence

types of due diligence

-

Financial Due Diligence: A cornerstone of due diligence, financial audits verify the accuracy of financial records presented in the Confidentiality Information Memorandum (CIM). The aim is to understand financial performance, stability, and identify any hidden issues. This involves meticulously carrying out a review of:

- Financial statements

- Company forecasts and projections

- Inventory schedules

-

Legal Due Diligence: Legal due diligence determines if the target company faces legal challenges or non-compliance issues. It includes thoroughly undertaking a review of:

- Contracts

- Corporate documents

- Board meeting minutes

- Compliance policies and procedures

-

Human Resources Due Diligence: HR due diligence focuses on a company’s employees, its most valuable asset. It aims to understand:

- Organizational structure

- Compensation and benefits packages

- Employee vacancy rates

- Union agreements (if applicable)

- History of harassment claims or wrongful termination lawsuits

-

Operational Due Diligence: Operational due diligence examines all facets of a company’s operations to assess the state of technology, assets, and facilities, and to uncover any hidden risks or liabilities.

-

Environmental Due Diligence: Environmental due diligence verifies compliance with environmental regulations to prevent future penalties, ranging from fines to plant closures.

-

Business Due Diligence: Business due diligence identifies the company’s customer base and industry position, helping to predict the transaction’s impact and risks on the acquiring firm’s existing customers.

-

Strategic Fit Due Diligence: This assesses the target company’s alignment with the buyer’s strategic goals and objectives, evaluating:

- Potential synergies

- Transaction benefits

- Integration compatibility

-

Self-Assessment Due Diligence: Often neglected, self-assessment is crucial. It’s an introspective approach where firms define their needs and objectives for the transaction right from the outset.

Leveraging Due Diligence Templates and Checklists

DealRoom’s Playbooks streamline due diligence management from initiation to completion. Given the complexity and numerous components of due diligence, effective management is critical for deal success.

DealRoom’s library of pre-built playbooks enables teams to efficiently and effectively gather necessary diligence information.

Click here to explore the templates gallery

Examples of Due Diligence in Practice

Here are several examples illustrating the application of due diligence:

- Conducting detailed property inspections before purchase to ensure sound investment.

- An underwriter auditing an issuer’s business and operations before selling securities.

- A business thoroughly examining another company to assess investment suitability before a merger.

Using “Due Diligence” in Sentences: Examples

Here are examples of “due diligence” used in sentences:

- The acquiring firm exercised due diligence on the target company before finalizing the contract.

- Post due diligence, the firm realized they had initially overvalued the investment, leading to contract termination.

- The extensive due diligence process, due to the target company’s complexity, exceeded the buyout group’s initial timeline.

Synonyms for Due Diligence

Analysis, assessment, audit, examination, review, survey, verification, investigation.

Due Diligence Costs and Fees

Due diligence incurs costs from internal employee time and third-party professionals (lawyers, consultants, accountants). Costs depend heavily on the process scope, intensity, and target company complexity. Typically, both sides engage and compensate third-party due diligence teams.

In some cases, buyers may bill sellers for associated costs after transaction completion.

Further Reading: Overview of Costs in M&A and How to Reduce Them

Streamlining Due Diligence with DealRoom

Traditionally, due diligence involves disparate software, lengthy email chains, and fragmented communication, leading to inefficiencies, disorganization, miscommunications, and missed deadlines.

DealRoom M&A Platform](https://dealroom.net/) offers a unified solution to overcome these challenges, consolidating diligence requests and documents for all parties involved.

DealRoom Diligence provides:

- Enhanced Diligence Efficiency: Unifying requests and documents in an intuitive platform eliminates errors from using multiple tools.

- 25+ Manual Hours Saved: Automating workflows and streamlining communication accelerates due diligence timelines.

- Eliminated Misalignment: Centralized platform ensures all parties are on the same page.

To learn more, click here.