Ride-hailing giant Uber Technologies and AI chip powerhouse Nvidia once shared a common interest as major shareholders in Serve Robotics (SERV). However, recent news revealed that Nvidia divested its entire stake in Serve at the close of 2024, triggering a significant downturn in Serve’s stock, plummeting over 50%.

Serve Robotics specializes in autonomous last-mile delivery robots, leveraging Nvidia’s technology. The company is gearing up to deploy thousands of these robots this year under a partnership with Uber Eats. Investors are keenly awaiting Serve’s Q4 2024 financial results, due on March 6th, for insights into the company’s progress.

Could this sharp 50% decrease in Serve stock present a valuable entry point for investors ahead of the financial report?

The Future Landscape of Last-Mile Logistics

Serve Robotics argues that current food delivery systems are inefficient due to their reliance on human labor and vehicles, both representing substantial costs. The company champions autonomous robots and drones as a more economical solution for last-mile delivery, particularly for smaller payloads. This is further supported by the decreasing costs associated with developing AI hardware and software.

Serve’s robots boast Level 4 autonomy, enabling them to navigate sidewalks in designated areas without human intervention. Since 2022, they have successfully completed over 50,000 deliveries for approximately 400 restaurants in Los Angeles, achieving an impressive 99.94% accuracy rate. This performance underscores a tenfold increase in efficiency compared to human delivery personnel.

The latest iteration, Serve’s Gen3 robot, marks a significant upgrade. It delivers five times the power of its predecessor, featuring enhanced speed, extended operational hours, and a broader range. This advancement translates to a 50% reduction in operating costs. Gen3 is powered by Nvidia’s Jetson Orin platform, integrating the necessary hardware and software for computer vision and advanced robotics functionalities.

While traditional Uber Eats deliveries using human drivers can incur fees ranging from zero to $8, excluding service fees and tips, Serve aims to consistently bring its delivery cost down to $1. This cost-effectiveness promises substantial savings for customers, potentially driving order volumes and benefiting all stakeholders involved.

Serve Robotics envisions a vast market for autonomous food delivery, estimating it could reach $450 billion by 2030, based on research from Ark Investment Management. The company’s plan to deploy 2,000 robots this year through the Uber Eats partnership will expand its footprint in California and venture into new markets. Notably, Serve launched its Miami service on February 19th, partnering with Shake Shack and Mister O1 Extraordinary Pizza for Uber Eats deliveries.

Rapid Revenue Growth vs. Substantial Losses at Serve

Wall Street’s consensus forecasts, as compiled by Yahoo!, anticipate Serve Robotics’ upcoming financial report to reveal approximately $1.9 million in total revenue for 2024. This represents a staggering 820% increase compared to the previous year.

Looking ahead to 2025, analysts project even more impressive growth, expecting revenue to surge to $13.3 million, a further 598% increase. This exponential growth hinges on the successful deployment of the 2,000 robots under the Uber Eats agreement. If Serve achieves this milestone, 2025 will be a pivotal year, validating its business model.

However, like many startups, particularly in the AI and robotics sectors, Serve Robotics is currently operating at a significant loss. In the first three quarters of 2024, the company reported a $26.1 million loss, following a $24.8 million loss in 2023. With $50.9 million in cash reserves at the end of Q3 2024, maintaining this rate of loss is unsustainable.

Serve Robotics secured an additional $80 million in January through a new stock issuance. While this capital injection provides necessary funding, such dilutive measures cannot be a long-term strategy. Addressing the substantial losses will be crucial for the company’s financial health.

Serve Stock’s Premium Valuation Despite the Dip

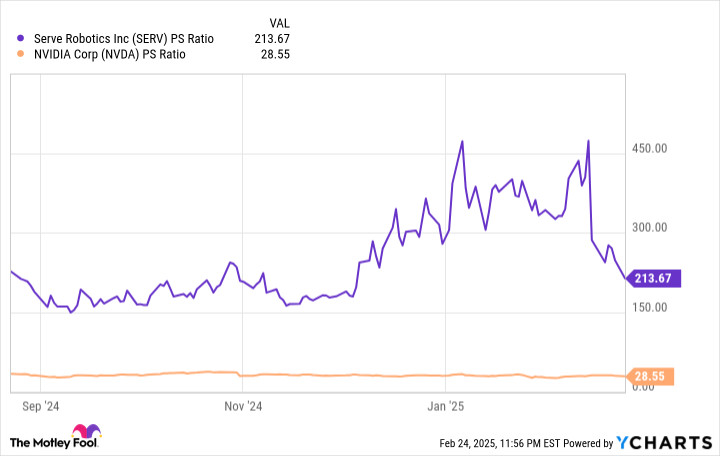

As of this writing, Serve Robotics holds a market capitalization of $581 million. Based on its trailing-12-month revenue, the stock’s price-to-sales (P/S) ratio stands at an exorbitant 213.6. To put this in perspective, Serve’s valuation is seven times higher than Nvidia’s, which trades at a P/S ratio of 28.5.

Serve Robotics Price to Sales Ratio Compared to Industry Peers

Serve Robotics Price to Sales Ratio Compared to Industry Peers

SERV PS Ratio data by YCharts

Even when considering the projected 2025 revenue of $13.3 million, Serve’s forward P/S ratio remains elevated at 45.1. This still positions it as significantly more expensive than Nvidia, a company projected to generate over $195 billion in revenue in its current fiscal year, along with substantial profits. The premium valuation of Serve compared to a high-caliber company like Nvidia raises concerns.

While Serve Robotics has the potential to become a significant player in the robotics industry, capitalizing on a potentially massive addressable market, the current stock valuation appears excessively high. The recent 50% stock dip might not be sufficient to bring the valuation to a reasonable level. The upcoming financial report on March 6th is unlikely to drastically alter this outlook.

Therefore, for investors considering Serv Robotics Stock, a cautious approach may be warranted. Monitoring the company’s progress in curbing losses and achieving sustainable growth will be crucial before considering it as a compelling investment opportunity.