Serve Robotics stock dropping has become a significant concern for investors, and at rental-server.net, we’re here to break down the complexities of this situation. We’ll explore the factors influencing the stock’s recent performance and offer insights into the broader context of the robotics and automation industry, providing a clear understanding and potential strategies forward, including cloud server options. Let’s delve into the world of server solutions, dedicated server options, and VPS hosting as we analyze the dynamics affecting Serve Robotics’ stock.

1. Understanding Serve Robotics’ Stock Performance

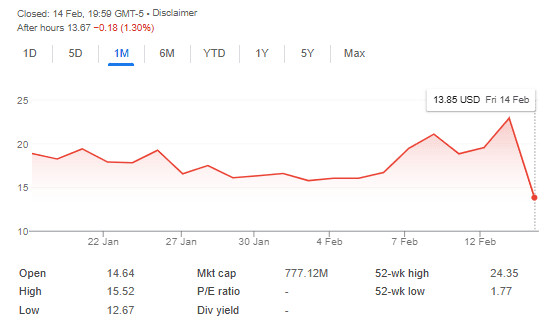

Why Is Serve Robotics Stock Dropping? The recent performance of Serve Robotics’ stock has indeed been volatile. A significant drop on February 14, 2025, saw the share price plummet by 39.57%, falling from $22.92 to $13.852. This fluctuation indicates increased trading volatility, with the stock oscillating between $12.67 and $15.513 within the same day, a daily swing of 22.42%. This kind of movement understandably raises questions about the company’s stability and future prospects.

The stock’s performance can be attributed to a combination of factors, including short-term market corrections and investor sentiment. While Serve Robotics may have a positive long-term growth trend, immediate indicators have turned negative, leading to a recent evaluation adjustment from “Strong Buy” to “Sell.” Investors are closely monitoring the situation to determine whether the stock will recover or continue to decline.

1.1. Short-Term Market Corrections

Why is Serve Robotics stock dropping? Short-term market corrections can significantly impact stock prices, especially for companies in high-growth sectors like robotics. These corrections often result from broader economic concerns, such as interest rate hikes or inflation fears, causing investors to re-evaluate their portfolios and sell off riskier assets. The ripple effect can lead to a temporary downturn in the stock prices of companies like Serve Robotics, even if their long-term prospects remain strong.

1.2. Investor Sentiment

Why is Serve Robotics stock dropping? Investor sentiment plays a crucial role in stock performance. News and market rumors, whether positive or negative, can quickly influence how investors perceive a company’s value. In the case of Serve Robotics, factors like changes in short interest or analyst ratings can sway investor confidence, leading to increased selling pressure and a subsequent drop in stock price. Monitoring market sentiment is essential for understanding the underlying drivers of stock volatility.

1.3. Industry-Specific Challenges

Why is Serve Robotics stock dropping? The robotics industry, while promising, faces its unique set of challenges. These include high research and development costs, regulatory hurdles, and the need for continuous innovation to stay ahead of the competition. Companies like Serve Robotics must navigate these challenges effectively to maintain investor confidence and sustain stock performance.

1.4. Comparison Table of Factors Influencing Stock Performance

| Factor | Description | Impact on Stock Price |

|---|---|---|

| Short-Term Market Corrections | Broader economic concerns leading to portfolio re-evaluation. | Negative |

| Investor Sentiment | News and market rumors affecting investor confidence. | Fluctuating |

| Industry-Specific Challenges | High R&D costs, regulatory hurdles, and the need for continuous innovation. | Potentially Negative |

| Company-Specific News | Announcements related to partnerships, contracts, or financial performance. | Fluctuating |

Serve Robotics Stock 1-month Chart

Serve Robotics Stock 1-month Chart

2. The Impact of Short Interest on Serve Robotics

What impact do short interests have on Why is Serve Robotics stock dropping? An intriguing aspect of Serve Robotics’ stock activity is the noticeable dip in short interest. Between January 15 and January 31, 2025, shorted shares decreased by 22.2%. On January 15, investors had shorted a total of 6,500,000 shares. By the end of the month, this figure had fallen to 5,060,000 shares. Despite this decrease, short interest remains relatively high, with 18.4% of the company’s stock currently sold short.

This level of short interest typically indicates mixed sentiment among investors regarding the stock’s near-term movements. Short interest refers to the number of shares that have been sold short but not yet covered or closed out. A high short interest can suggest that many investors believe the stock price will decline, while a decrease in short interest may indicate a shift in sentiment.

2.1. Understanding Short Selling

What does short selling mean in the context of Why is Serve Robotics stock dropping? Short selling is a trading strategy where investors borrow shares of a stock they believe will decrease in value and sell them on the open market. The goal is to buy back these shares at a lower price in the future and return them to the lender, profiting from the difference. Short selling can be a risky strategy, as losses can be unlimited if the stock price rises instead of falling.

2.2. Short Interest as a Sentiment Indicator

Why is Serve Robotics stock dropping? Short interest is often used as a sentiment indicator, reflecting the overall outlook of investors towards a particular stock. A high short interest can indicate bearish sentiment, suggesting that many investors expect the stock price to decline. Conversely, a low short interest may indicate bullish sentiment, suggesting that most investors expect the stock price to increase.

2.3. The Dynamics of a Short Squeeze

What is a short squeeze and how does it relate to Why is Serve Robotics stock dropping? A short squeeze occurs when a stock with high short interest experiences a sudden increase in price. This forces short sellers to cover their positions by buying back the shares they borrowed, driving the price even higher. Short squeezes can be volatile and unpredictable, leading to significant gains for those who bet against the short sellers.

2.4. Table of Short Interest Indicators

| Indicator | Description | Implication for Stock Price |

|---|---|---|

| High Short Interest | A large number of shares sold short relative to the total shares outstanding. | Potential for Price Decline |

| Decreasing Short Interest | A decrease in the number of shares sold short over a period. | Potential for Price Increase |

| Short Squeeze | A sudden increase in stock price forcing short sellers to cover their positions. | Rapid Price Increase |

3. Nvidia’s Role in Serve Robotics’ Stock Decline

How did Nvidia affect Why is Serve Robotics stock dropping? Nvidia’s recent decision to exit its stake in Serve Robotics has indeed played a role in the company’s stock performance. According to regulatory filings, Nvidia sold its entire holding in Serve Robotics during the fourth quarter of 2024. Previously, Nvidia held a 10% stake in the company, which was disclosed in July 2024. The divestment was part of a broader portfolio adjustment by Nvidia, which also included reducing its stake in other companies like Arm Holdings and SoundHound AI.

This move by Nvidia appears to have shaken investor confidence, contributing to Serve Robotics’ stock drop. The exit sent a signal to the market, leading to a 42% decline in Serve Robotics’ share price following the announcement. While Nvidia’s decision aligns with its strategic focus on other areas, such as investments in China’s WeRide, it could have a noticeable impact on Serve Robotics’ market perception.

3.1. Nvidia’s Strategic Divestment

What does Nvidia’s divestment strategy entail in the context of Why is Serve Robotics stock dropping? Nvidia’s decision to divest its stake in Serve Robotics reflects a strategic shift in its investment portfolio. Companies like Nvidia often re-evaluate their holdings to focus on core business areas or pursue new opportunities. While the exact reasons for the divestment may not be publicly disclosed, it is common for companies to adjust their investments based on market trends, financial performance, and strategic priorities.

3.2. Market Reaction to Nvidia’s Exit

Why is Serve Robotics stock dropping? The market’s reaction to Nvidia’s exit from Serve Robotics highlights the influence that major investors can have on a company’s stock price. When a well-known company like Nvidia reduces or eliminates its stake in a smaller company, it can create uncertainty and trigger a sell-off by other investors. This is often due to concerns about the smaller company’s future prospects or a perception that the larger investor has lost confidence in the business.

3.3. Nvidia’s Focus on WeRide

How does Nvidia’s focus on WeRide impact Why is Serve Robotics stock dropping? Nvidia’s increased focus on companies like WeRide, particularly in the Chinese market, underscores the strategic nature of its investment decisions. WeRide is a leading autonomous driving company in China, and Nvidia’s investment signals a strong interest in the growing autonomous vehicle market in that region. This shift in focus may have contributed to the decision to divest from Serve Robotics, as Nvidia prioritizes opportunities with greater potential for growth and synergy with its core business.

3.4. Table of Nvidia’s Investment Strategies

| Investment Decision | Description | Impact on Serve Robotics Stock |

|---|---|---|

| Divestment from Serve Robotics | Sale of Nvidia’s 10% stake in Serve Robotics during Q4 2024. | Negative |

| Focus on WeRide | Increased investment in the Chinese autonomous driving company, WeRide. | Indirectly Negative |

| Portfolio Adjustment | Broader strategic shift involving reductions in stakes in Arm Holdings and SoundHound AI. | Indirectly Negative |

4. Serve Robotics: Company Overview

What does Serve Robotics do and how does that impact Why is Serve Robotics stock dropping? When it comes to what Serve Robotics does, it’s all about disrupting the delivery process, something you or your neighborhood might have already seen in action. The company specializes in designing and operating low-emission, self-driving delivery robots. These robots are primarily used in the U.S. food delivery market, targeting sustainability and efficiency for last-mile logistics.

From reducing emissions to creating an autonomous delivery ecosystem, Serve Robotics has carved out its spot as a leader in this niche. It’s no wonder the brand has caught attention for its ambitious approach to innovation, even as its stock performance raises questions.

4.1. Sustainable Delivery Solutions

How does Serve Robotics aim to provide sustainable delivery solutions related to Why is Serve Robotics stock dropping? Serve Robotics is committed to providing sustainable delivery solutions through its use of low-emission, self-driving robots. These robots are designed to reduce the environmental impact of last-mile delivery by minimizing carbon emissions and traffic congestion. The company’s focus on sustainability aligns with growing consumer demand for eco-friendly products and services.

4.2. Autonomous Delivery Ecosystem

What is an autonomous delivery ecosystem and how does that impact Why is Serve Robotics stock dropping? Serve Robotics aims to create an autonomous delivery ecosystem by deploying its self-driving robots in urban areas. This ecosystem involves integrating the robots with local businesses and delivery services to provide efficient and cost-effective delivery solutions. The company’s vision is to transform the way goods are transported in cities, making delivery faster, cheaper, and more environmentally friendly.

4.3. Focus on Last-Mile Logistics

Why is last-mile logistics important in relation to Why is Serve Robotics stock dropping? Serve Robotics focuses on last-mile logistics, which refers to the final step in the delivery process from a transportation hub to the customer’s doorstep. This is often the most expensive and inefficient part of the supply chain, accounting for a significant portion of total delivery costs. By automating last-mile delivery with its self-driving robots, Serve Robotics aims to improve efficiency and reduce costs for businesses.

4.4. Table of Serve Robotics’ Key Operations

| Operation | Description | Impact on Market Position |

|---|---|---|

| Low-Emission Robots | Designing and operating self-driving robots with minimal environmental impact. | Competitive Advantage |

| Autonomous Delivery Ecosystem | Integrating robots with local businesses for efficient delivery services. | Market Disruption |

| Last-Mile Logistics Focus | Automating the final step of delivery to reduce costs and improve efficiency. | Cost Leadership |

Who are the 10 Best Regulated Forex Brokers With the Highest Leverage?

Who are the 10 Best Regulated Forex Brokers With the Highest Leverage?

5. Frequently Asked Questions About Serve Robotics Stock

5.1. Why is SERV stock falling?

Why is Serve Robotics stock dropping? SERV stock has recently faced challenges related to market volatility and portfolio adjustments by major investors. Additionally, short-term market signals have contributed to decreased investor confidence. Factors such as Nvidia’s divestment and broader economic concerns can all play a role in the stock’s decline.

5.2. What is the future of Serve Robotics stock?

What does the future hold for Why is Serve Robotics stock dropping? The future of Serve Robotics stock will depend on market conditions, company performance, and its ability to continue innovating in the robotics sector. Investors will observe closely as the company navigates its current challenges and adapts to changing market dynamics.

5.3. Is SERV stock a good buy?

Is it wise to invest in Why is Serve Robotics stock dropping? Whether SERV stock is a good buy depends on individual investment strategies, risk tolerance, and long-term objectives. Consulting with a financial advisor can provide tailored insights and help investors make informed decisions based on their personal circumstances.

5.4. Is Serve Robotics profitable?

Is Serve Robotics currently profitable given that Why is Serve Robotics stock dropping? Serve Robotics is not currently profitable as it continues to invest in product development and business expansion. Like many tech startups, the focus remains on innovation and market growth rather than immediate profitability.

5.5. What does Serve Robotics do?

What services does Serve Robotics provide in relation to Why is Serve Robotics stock dropping? Serve Robotics designs and operates autonomous, low-emission delivery robots. These robots are primarily used in the U.S. for food delivery services, aiming to enhance sustainability in last-mile logistics.

5.6. Is Serve Robotics stock Buy or Sell?

What is the official rating for Why is Serve Robotics stock dropping? Recent evaluations have downgraded Serve Robotics stock from “Strong Buy” to “Sell” based on short-term market signals. Investors should consider their own research or consult financial experts before making decisions. These ratings can change frequently based on market conditions and company performance.

5.7. What is Serve Robotics stock prediction 2025?

What are the predictions for the stock in 2025 considering that Why is Serve Robotics stock dropping? Predictions for Serve Robotics stock by 2025 can vary based on industry trends, economic conditions, and company performance. No definitive forecast is available, and investors are advised to review market analyses and consult with financial experts.

5.8. When is Serve Robotics earnings date?

When can we expect Serve Robotics to announce their earnings amid Why is Serve Robotics stock dropping? Serve Robotics has not officially announced its next earnings date at this time. Typically, investors can track earnings schedules through the company’s investor relations page or financial news outlets. Monitoring earnings announcements is crucial for staying informed about the company’s financial health.

5.9. How does server technology relate to Serve Robotics?

How do the servers utilized by Serve Robotics affect Why is Serve Robotics stock dropping? While Serve Robotics focuses on autonomous delivery robots, reliable server technology is crucial for managing their operations. High-performance servers are needed for data processing, route optimization, and real-time monitoring of the robot fleet. Companies that rely on robust IT infrastructure often consider options like dedicated servers, VPS (Virtual Private Servers), or cloud servers to ensure seamless performance.

5.10. What kind of server solutions are best for robotics companies like Serve Robotics?

What server solutions are optimal for robotics companies similar to the one experiencing Why is Serve Robotics stock dropping? Robotics companies often require scalable and reliable server solutions to support their operations. Dedicated servers offer maximum performance and control, which is essential for handling large amounts of data and complex algorithms. VPS hosting provides a cost-effective alternative with dedicated resources, while cloud servers offer scalability and flexibility to adapt to changing needs.

6. The Importance of Server Solutions for Robotics Companies

Why is it important for robotics companies to have good server solutions in relation to Why is Serve Robotics stock dropping? In the realm of robotics and automation, server solutions play a pivotal role in ensuring smooth operations, efficient data management, and seamless connectivity. For companies like Serve Robotics, which rely on autonomous systems and real-time data processing, having robust server infrastructure is essential for maintaining competitiveness and driving innovation. Let’s explore the significance of server solutions for robotics companies:

6.1. Data Processing and Analysis

How do servers facilitate data processing and analysis for robotics companies like the one undergoing Why is Serve Robotics stock dropping? Robotics companies generate vast amounts of data from various sources, including sensors, cameras, and other devices. This data needs to be processed and analyzed in real-time to make informed decisions and optimize performance. Server solutions provide the necessary computing power and storage capacity to handle these data-intensive tasks, enabling companies to extract valuable insights and improve their operations.

6.2. Real-Time Monitoring and Control

How do servers allow for real-time monitoring and control given that Why is Serve Robotics stock dropping? Many robotics applications require real-time monitoring and control to ensure safety, reliability, and efficiency. Server solutions enable companies to remotely monitor and control their robotic systems, track performance metrics, and respond to unexpected events. This level of control is crucial for maintaining operational integrity and minimizing downtime.

6.3. Scalability and Flexibility

How do servers scale and flex to meet the needs of Why is Serve Robotics stock dropping? Robotics companies often experience rapid growth and evolving needs, making scalability and flexibility essential requirements for their server infrastructure. Server solutions that can easily scale up or down based on demand allow companies to adapt to changing market conditions and accommodate new applications and technologies. This agility is crucial for maintaining competitiveness and driving innovation.

6.4. Types of Server Solutions

What server solutions are available for Why is Serve Robotics stock dropping? There are several types of server solutions available, each with its unique advantages and disadvantages. Dedicated servers offer maximum performance and control, making them ideal for data-intensive applications. VPS hosting provides a cost-effective alternative with dedicated resources, while cloud servers offer scalability and flexibility. The choice of server solution depends on the specific needs and budget of the robotics company.

6.5. Table of Server Solution Comparisons

| Server Solution | Description | Advantages | Disadvantages |

|---|---|---|---|

| Dedicated Servers | Physical servers dedicated to a single customer. | Maximum performance, full control, high security. | Higher cost, requires technical expertise for management. |

| VPS Hosting | Virtual servers sharing physical hardware with other customers. | Cost-effective, dedicated resources, scalable. | Limited control compared to dedicated servers, potential for resource contention. |

| Cloud Servers | Virtual servers hosted on a cloud infrastructure. | Scalable, flexible, pay-as-you-go pricing. | Can be more expensive than VPS for consistent workloads, requires careful configuration for security. |

7. How Rental-Server.net Can Help

Why should you choose Rental-Server.net regarding Why is Serve Robotics stock dropping? At rental-server.net, we understand the critical role that server solutions play in the success of robotics companies. We offer a wide range of server options, including dedicated servers, VPS hosting, and cloud servers, to meet the diverse needs of our clients. Our team of experts can help you choose the right server solution for your specific requirements and provide ongoing support to ensure optimal performance.

7.1. Wide Range of Server Options

What options does Rental-Server.net offer for Why is Serve Robotics stock dropping? Rental-Server.net provides a comprehensive selection of server options to cater to the varying needs of robotics companies. Whether you require the dedicated resources of a dedicated server, the cost-effectiveness of VPS hosting, or the scalability of cloud servers, we have a solution to meet your requirements. Our diverse range of server options ensures that you can find the perfect fit for your business needs.

7.2. Expert Guidance and Support

How does Rental-Server.net provide expertise and support with Why is Serve Robotics stock dropping? Our team of experienced professionals is dedicated to providing expert guidance and support to help you navigate the complexities of server selection and management. We can assess your specific requirements, recommend the most suitable server solution, and provide ongoing support to ensure optimal performance. With Rental-Server.net, you can rest assured that you have a trusted partner to support your server infrastructure needs.

7.3. Scalable and Flexible Solutions

How does Rental-Server.net provide scaling and flexibility when considering Why is Serve Robotics stock dropping? Rental-Server.net offers scalable and flexible server solutions that can adapt to the evolving needs of your robotics company. Whether you experience rapid growth or changing market conditions, our server solutions can easily scale up or down to accommodate your requirements. This agility ensures that you can maintain competitiveness and drive innovation without being constrained by your server infrastructure.

7.4. Contact Us Today

How can I contact Rental-Server.net to learn more about Why is Serve Robotics stock dropping? Ready to explore the perfect server solutions for your robotics company? Contact Rental-Server.net today to discuss your specific needs and discover how we can help you optimize your server infrastructure. Our team is ready to provide expert guidance, answer your questions, and help you make informed decisions.

You can reach us at:

- Address: 21710 Ashbrook Place, Suite 100, Ashburn, VA 20147, United States

- Phone: +1 (703) 435-2000

- Website: rental-server.net

8. Navigating the Challenges and Opportunities

Why is it important to navigate the challenges related to Why is Serve Robotics stock dropping? While Serve Robotics has seen fluctuations in its stock performance, its innovative role in the self-driving delivery space remains important. The company continues to be a pioneer in sustainable logistics and automation, and its efforts in advancing this technology are impactful. Whether you’re an investor or simply interested in robotics trends, Serve Robotics offers a captivating mix of challenges and opportunities. Keep an eye on its progress as the year unfolds, as it’s clear there’s more to come from this robotics leader.

8.1. Embracing Innovation and Sustainability

How does innovation and sustainability affect Why is Serve Robotics stock dropping? Serve Robotics’ commitment to innovation and sustainability positions it as a key player in the future of logistics and automation. By embracing new technologies and focusing on environmentally friendly solutions, the company is well-positioned to capitalize on growing demand for sustainable delivery services. Investors and industry observers should continue to monitor Serve Robotics’ progress as it navigates the challenges and opportunities ahead.

8.2. Monitoring Market Trends and Investor Sentiment

How does one monitor market trends and investor sentiment regarding Why is Serve Robotics stock dropping? Staying informed about market trends and investor sentiment is crucial for understanding the dynamics of Serve Robotics’ stock performance. By monitoring financial news, industry reports, and analyst ratings, investors can gain valuable insights into the factors influencing the stock’s price and make informed decisions. Keeping a close eye on these trends can help investors anticipate potential challenges and opportunities.

8.3. Seeking Expert Financial Advice

Why should investors seek expert financial advice to understand Why is Serve Robotics stock dropping? Given the complexities of the stock market and the uncertainties surrounding Serve Robotics’ future, seeking expert financial advice is highly recommended. A qualified financial advisor can provide personalized guidance based on your individual investment goals, risk tolerance, and financial situation. Consulting with a financial advisor can help you make informed decisions and manage your investments effectively.

8.4. Table of Recommendations

| Recommendation | Description | Benefit |

|---|---|---|

| Embrace Innovation | Continue to develop and implement new technologies to improve efficiency and sustainability. | Maintain competitive advantage and attract new customers. |

| Monitor Market Trends | Stay informed about industry developments and investor sentiment. | Make informed investment decisions and anticipate potential challenges. |

| Seek Expert Financial Advice | Consult with a qualified financial advisor for personalized guidance. | Manage investments effectively and achieve financial goals. |

9. Conclusion

Why should you care about Why is Serve Robotics stock dropping? Understanding the factors influencing Serve Robotics’ stock performance is essential for investors and industry observers alike. From market volatility and investor sentiment to company-specific news and strategic decisions, a variety of elements can impact the stock’s price. By staying informed, seeking expert advice, and monitoring market trends, investors can navigate the challenges and opportunities associated with Serve Robotics and make informed decisions about their investments.

Remember, for reliable and scalable server solutions that can support the operations of robotics companies like Serve Robotics, rental-server.net is here to help. Contact us today to learn more about our wide range of server options and how we can assist you in optimizing your server infrastructure.

Disclaimer

All information has been prepared by Rental-Server.net or partners. The information does not contain a record of rental-server.net or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.