Nvidia, the tech behemoth synonymous with cutting-edge graphics and artificial intelligence, finds itself navigating a challenging landscape. While not literally facing billions of bikes or serving subpoenas on two wheels, the company has been served with subpoenas by the U.S. Department of Justice (DOJ). This legal action marks a significant escalation in the ongoing scrutiny of the Silicon Valley chipmaker’s dominance in the artificial intelligence market, a sector where fortunes are indeed measured in billions.

DOJ Intensifies Antitrust Probe into Nvidia’s AI Chip Market Grip

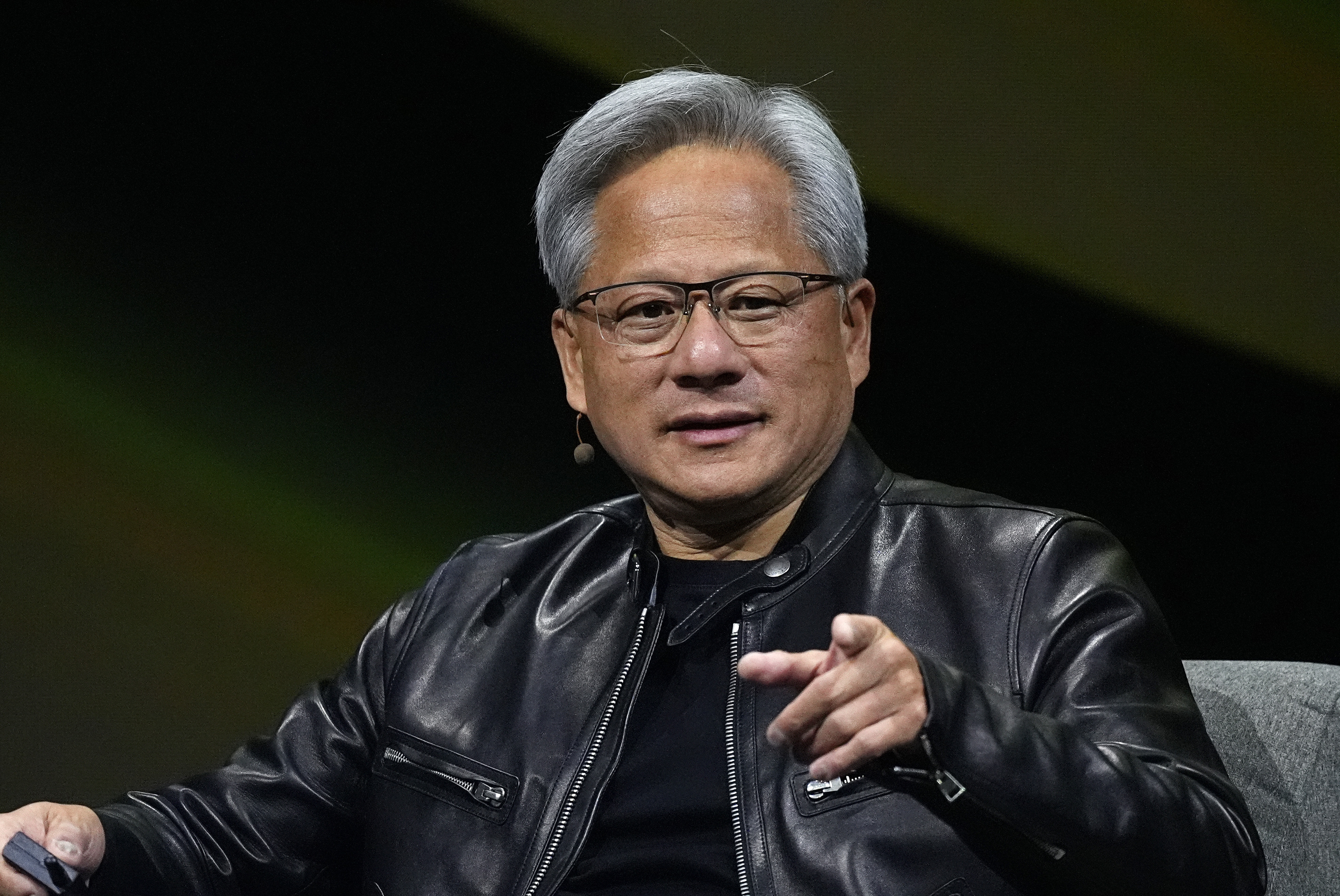

The Justice Department’s antitrust division is stepping up its investigation into Nvidia, moving beyond initial questionnaires to issuing legally binding subpoenas. This development, first reported by Bloomberg News, signals a serious deepening of the regulatory pressure on the Jensen Huang-led company. While Nvidia declined to offer specific comments on the subpoena, a spokesperson affirmed the company’s commitment to cooperating with regulators and adhering to all applicable laws. They highlighted Nvidia’s decades of investment and innovation, emphasizing their open availability across cloud and on-premise solutions, and their dedication to customer choice.

[ Nvidia CEO Jensen Huang, whose company is under DOJ investigation. ]

Nvidia CEO Jensen Huang, whose company is under DOJ investigation. ]

The investigation comes amidst growing concerns about Nvidia’s commanding position in the AI chip market, where it reportedly controls approximately 80% market share. These concerns have been fueled by allegations that Nvidia has leveraged this dominance in potentially anticompetitive ways. Specifically, reports suggest that Nvidia has pressured cloud providers to bundle purchases and may have penalized customers who opted for AI chips from rival companies like Advanced Micro Devices (AMD) and Intel by imposing higher prices on networking equipment.

Market Volatility and Regulatory Scrutiny Follow Subpoena News

News of the DOJ subpoena coincided with a turbulent day for Nvidia in the stock market. The company experienced a staggering $279 billion plunge in market capitalization as its stock price plummeted nearly 10%. This dramatic downturn was part of a broader global selloff that dampened investor enthusiasm for AI stocks. For CEO Jensen Huang personally, this market correction translated to a $10 billion reduction in his net worth, according to the Bloomberg Billionaires Index.

[ Assistant Attorney General Jonathan Kanter leading the DOJ antitrust division. ]

Assistant Attorney General Jonathan Kanter leading the DOJ antitrust division. ]

The DOJ’s antitrust division, spearheaded by Assistant Attorney General Jonathan Kanter, has been increasingly active in scrutinizing Big Tech’s market power. This investigation into Nvidia aligns with a broader trend of regulatory bodies on both sides of the Atlantic examining the competitive landscape of the AI industry. Earlier this summer, French authorities also raised concerns about Nvidia’s business practices, further underscoring the mounting global regulatory pressure.

Nvidia’s Past Antitrust Battles and Future Challenges

This DOJ investigation is not Nvidia’s first encounter with antitrust scrutiny. In 2022, the company was forced to abandon its ambitious $40 billion acquisition of semiconductor giant ARM after the Federal Trade Commission (FTC) intervened to block the deal. The FTC, under Chair Lina Khan, has adopted a more assertive stance against alleged antitrust violations by major technology companies.

[ The Nvidia logo, a symbol of its dominance in AI and graphics chips. ]

The Nvidia logo, a symbol of its dominance in AI and graphics chips. ]

The current investigation and past regulatory challenges highlight the delicate balance Nvidia must maintain between innovation, market leadership, and antitrust compliance. As demand for AI chips continues to surge, fueled by applications like ChatGPT, Nvidia’s every move will be closely watched by regulators, competitors, and investors alike. The outcome of this DOJ investigation could have significant implications for the future of competition in the rapidly evolving artificial intelligence landscape and the broader tech industry.